Mortgage rates have been one of the hottest topics in the housing market lately because of their impact on affordability. And if you’re someone who’s looking to make a move, you’ve probably been waiting eagerly for rates to come down for that very reason. Well, if the past few weeks are any indication, you may be getting your wish.

Mortgage Rates Trend Down in Recent Weeks

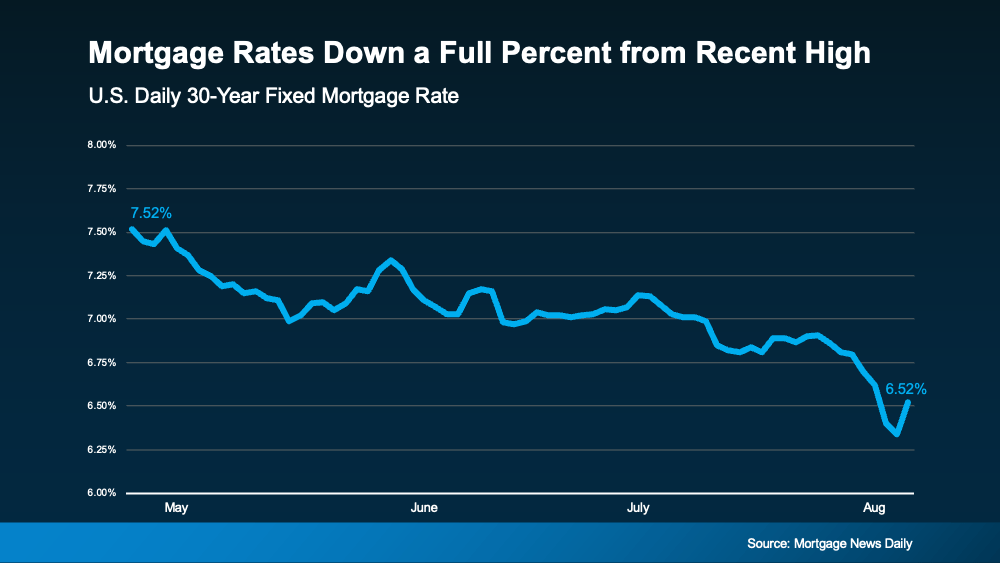

There’s big news for mortgage rates. After the latest reports on the economy, inflation, the unemployment rate, and the Federal Reserve’s recent comments, mortgage rates started dropping a bit. And according to Freddie Mac, they’re now at a level we haven’t seen since February. To help show the downward trend, check out the graph below:

Maybe you’re seeing this and wondering if you should ride the wave and see how low they’ll go. If that’s the case, here’s some important perspective. Remember, the record-low rates from the pandemic are a thing of the past. If you’re holding out hope to see a 3% mortgage rate again, you’re waiting for something experts agree won’t happen. As Greg McBride, Chief Financial Analyst at Bankrate, says:

Maybe you’re seeing this and wondering if you should ride the wave and see how low they’ll go. If that’s the case, here’s some important perspective. Remember, the record-low rates from the pandemic are a thing of the past. If you’re holding out hope to see a 3% mortgage rate again, you’re waiting for something experts agree won’t happen. As Greg McBride, Chief Financial Analyst at Bankrate, says:

“The hopes for lower interest rates need the reality check that ‘lower’ doesn’t mean we’re going back to 3% mortgage rates. . . the best we may be able to hope for over the next year is 5.5 to 6%.”

And with the decrease in recent weeks, you’ve got a big opportunity in front of you right now. It may be enough for you to want to jump back in.

The Relationship Between Rates and Demand

If you wait for mortgage rates to drop further, you might find yourself dealing with more competition as other buyers re-ignite their home searches too.

In the housing market, there’s generally a relationship between mortgage rates and buyer demand. Typically, the higher rates are, the lower buyer demand is. But when rates start to come down, things change. Buyers who were on the fence over higher rates will resume their searches. Here’s what that means for you. As a recent article from Bankrate says:

“If you’re ready to buy, now might be the time to strike. Home prices have been rising primarily because of a longstanding shortage of homes for sale. That’s unlikely to change, and if mortgage rates do fall below 6%, it’s possible buyers would enter the market en masse, further pushing up prices and resurrecting bidding wars.”

Bottom Line

If you’ve been waiting to make your move, the recent downward trend in mortgage rates may be enough to get you off the sidelines. Rates have hit their lowest point in months, and that gives you the opportunity to jump back in before all the other buyers do too.

If you’re ready and able to start the process, reach out to a local real estate professional to get started.